Transitional Employment — Apex Homecare & The Forum House:

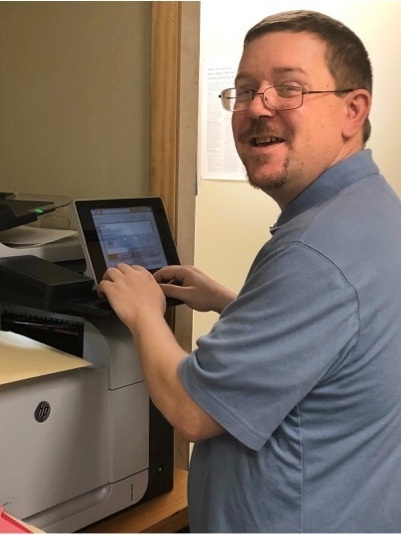

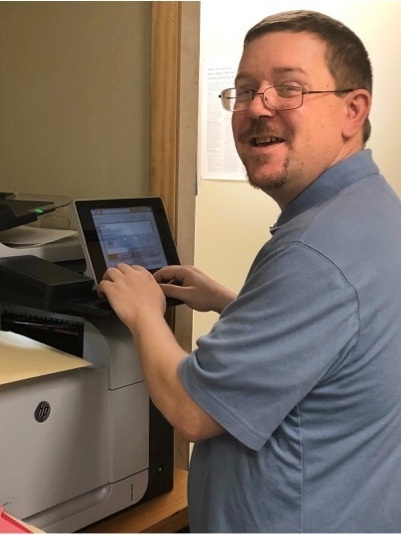

Jeremy Robert, a member from The Forum House transitional employment program is gainfully employed at Apex Homecare, in Springfield MA.

“When Jeremy’s on the job, we know he’s happy, from the big smile he wears on his face,” said Cheryl Rumley, Founder and President of Apex Homecare, a family owned home care agency serving Western Massachusetts (MA).

Jeremy first arrived at Apex with his support staff from the Forum House — Kevin, Lauren and Becca. The Forum House works in partnership with local employers to meet their business needs, while offering employment opportunities to people with disabilities in MA.

“Historically, I’ve hired home care aides from the Forum House and have always been pleased with the quality of their work”, Rumley said, “so I was confidant that Jeremy would also succeed.” In his role at Apex, Jeremy works in the document management department, scanning payroll and other documents into the new system recently installed at the home care agency.

The Forum House provides its members’ vocational training and skills to help them obtain employment. Using a “Clubhouse” Model, they offer a supportive environment and coaching to “Clubhouse Members”. This Transitional Employment (TE) approach ensures cooperation, inclusion and shared responsibility.

Employer’s fill job positions with a reliable workforce

“One great advantage of their model is absence coverage,” added Cheryl. “This demonstrates a commitment to the employer that will ensure the job gets done no matter what. I can count on Kevin, Lauren or Becca to step in and do the job if Jeremy is out for any reason. I encourage other business owners to utilize Transitional Employment from the Forum House because this program is so reliable.”

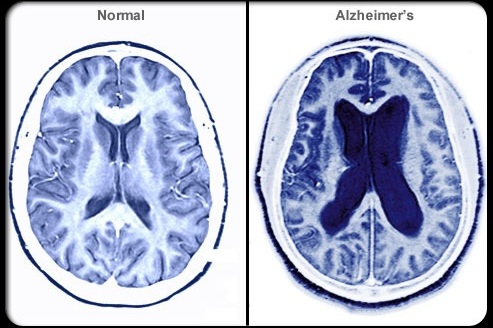

Alzheimer’s Disease Vs. Vascular Dementia.

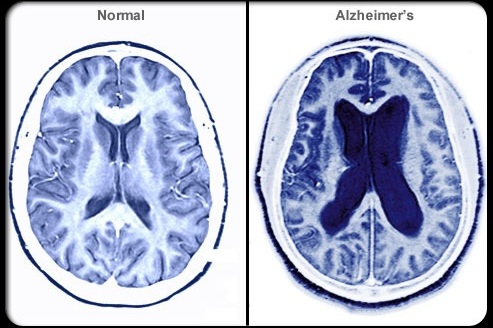

Many people do not know that there are two prominent diagnoses for dementia, Alzheimer’s Disease and Vascular Dementia.

The biggest difference in someone with vascular dementia and Alzheimer’s Disease is that Alzheimer’s is genuinely a disease in the brain.

Alzheimer’s Disease is a very severe and destructive loss of brain cells. Most people develop plaques and tangles in the brain as we age. Those with Alzheimer’s develop far more: Plaques are clusters of beta amyloid protein which build up between nerve cells and may lead to brain cell death. Tangles are strands of tau (pronounced like cow) which collapse and tangle together and may lead to brain cell dearth. Both of these structures are very small, we can’t see them with just our eyes. They are only visible with a powerful microscope after death. More and more plaques and tangles appear as the disease progresses. The normal brain weighs 3 pounds, and a normal brain will be about 3 pounds when the person dies. In a person with Alzheimer’s Disease the brain can shrink to less than a pound due to the paques and tangles killing brain cells.

Vascular dementia is the second most common form of dementia after Alzheimer's disease. It is caused by problems in the supply of blood to the brain. In a client with Vascular dementia usually the damage is so slight that the change is noticeable only as a series of small steps. However over time, as more small vessels are blocked due to a number of conditions which may include high blood pressure, heart problems, high cholesterol and diabetes there is a gradual mental decline. Over time memory and cognitive abilities such as maintaining the check book are lost. This disease is due to lack of oxygen to the brain. Sometimes, the symptoms of vascular dementia begin suddenly, for example after a stroke. Vascular dementia often follows a 'stepped' progression, with symptoms remaining at a constant level for a time and then suddenly deteriorating. Some symptoms may be similar to those of other types of dementia, such as Alzheimer's disease.

You should see you general practitioner for advice and possible referral to a specialist.

APEX HOMECARE WANTS BABY BOOMERS!

Make extra money caring for elders in your community. Work 10 to 15 hours per week.

Baby boomers face retirement crisis — little savings, high health costs and unrealistic expectations

Published Tue, Apr 9 2019 7:24 AM EDTUpdated Tue, Apr 9 2019 3:28 PM EDT

Let’s focus on baby boomers — those born between 1946 and 1964, ages 55 to 73. Nearly half (47%) are already in retirement.

That’s 34 million retired baby boomers.

Our dose of depressing data comes courtesy of the Insured Retirement Institute, which represents the annuity industry. The group’s annual report, Boomer Expectations for Retirement, highlights all the problems: too little savings, underestimating health costs and unrealistic expectations of how much retirement income they will need.

Too little savings

The three “legs” of the retirement “stool” are Social Security, private pensions and personal savings. None is in great shape. The average Social Security check is $14,000 a year, hardly a cushy retirement. Only 23 percent of boomers ages 56-61 expect to receive income from a private company pension plan, and only 38 percent of older boomers expect a pension. As for personal savings, I’ll make it simple: Most boomers have not saved nearly enough. In the worst case, it is really bad: 45% of boomers have zero savings for retirement.

Underestimating health care costs

Retirees routinely underestimate health expenses, particularly long-term care costs. Many simply don’t understand the system: Shockingly, 50% of those in the survey say they have not factored in the cost of long-term care insurance because they say they will rely on Medicare. But Medicare provides no coverage for long-term care. Only 8% of boomers say they have purchased a long-term care policy.

We are all going to live a lot longer than we think. In about half of all married couples over 65, one partner will survive to at least 95.

Underestimating retirement income

We are underestimating how much we are going to spend. The average amount spent by Americans 65-74 is $55,000 a year, but most baby boomers don’t think they will need anywhere near that amount. Indeed, 60% say they will need less than that to live on.

A lot of people are kidding themselves:

Expected annual retirement income need

· Less than $35,000 — 44%

· $35,000-$55,000 — 26%

· $55,000-$75,000 — 16%

· More than $75,000 — 14%

Source: Insured Retirement Institute

What’s the backup plan? What happens when a lot of people realize they haven’t thought this whole retirement thing through very well? Here’s the plan: Downsize, go back to work, or hit up the kids.

What will you do if you run out of money?

· Downsize, live on Social Security alone — 58%

· Return to work — 37%

· Ask children for assistance — 6%

Source: Insured Retirement Institute

The part about returning to work, or staying at work, is already happening. One-third of employed boomers ages 67 to 72 have postponed retirement, the study says.

Become a Home Health Aide, Call Apex Homecare, 413-746-4663 or visit apexcares.com and fill out an application. If you want to be a home care aide Apex can help train you.

Family Business. When Disaster Strikes

June 25, 2007

THE JOURNAL REPORT: SMALL BUSINESS

Family Business

When Disaster Strikes

A personal tragedy can sink a small business -- but it doesn't have to

By YULIYA CHERNOVA

June 25, 2007; Page R7

Cheryl Rumley, a 45-year-old single mother of three, borrowed from her brother and against her house to launch her own business, a home-care agency with a dozen employees. The business took off right away, quickly picking up 30 patients.

Six months later, Ms. Rumley learned she had breast cancer.

"'I don't have time for this,'" she protested, after her doctor told her she would need surgery, followed by eight months of chemotherapy and radiation treatments. Fighting cancer meant she wouldn't be able to dedicate her usual 60 hours a week to work.

Ms. Rumley thus found herself in a dual struggle for survival -- one for her life, and one for her business. "When you start a business," she says, "you really don't think you will die."

The fate of a company may seem unimportant compared with battling a serious illness or disability, or when a death occurs. But when such calamities strike at the owners of a small business, the repercussions can threaten the livelihoods of the owners and their families, and those of their employees and partners and their families.

Eight years after her diagnosis, Ms. Rumley's cancer is in remission, and her oldest son just graduated from college. Her home-care agency, Apex Healthcare Services Inc., Springfield, Mass., is thriving, with about 35 full-time employees and revenue that Ms. Rumley expects to reach about $1.2 million this year.

A look at the experiences of Ms. Rumley and other small-business owners who've faced similar situations helps shine a light on what can be a perilous path. What's clear is that when a small business is hit by a personal tragedy, it could spell the end of that small business. But it doesn't have to.

In particular, one theme runs through much of the advice offered by small-business experts: Business owners facing personal crises must be willing to delegate. "Those business owners who are entirely self-sufficient and are not going to yield any amount of control are the most subject to disasters," says Bob Cockrell, a family-business adviser in St. Louis.

What follows, then, is help on how small-business owners might best handle their businesses -- and themselves -- should misfortune arrive.

The Importance of No. 2

Having a reliable second-in-command and a well-structured organization is essential for ensuring smooth operations during an owner's absence or disability, or when a death occurs.

In the best scenario, the person taking charge is someone already working for the company who has had test runs as captain. Often the responsibility falls to a family member, though degrees of preparedness vary.

Olga Martinez, founder, president and chief executive of Allright Diversified Inc., a construction company in Fresno, Calif., working on government projects, had long wanted to involve her family in the business, but they weren't very interested, she says. Finally she added her younger brother to her business checking account and established him as an officer of her company. Six months later, she suffered a ruptured brain aneurysm. During her nearly yearlong illness and recovery, Ms. Martinez's brother took over most financial duties of the business. "He literally took over my purse," says Ms. Martinez, who adds that it was difficult for her to yield that control, but she was glad she did.

In choosing a successor, it's important for owners to not only groom them for the job but to make their choice widely known. Julie Smolyansky took over as chief executive of Lifeway Foods Inc., a dairy company in Morton Grove, Ill., after her father passed away from a heart attack in 2002. Although there was no formal succession plan, her father had told his business partners and staff that his daughter was next in line. She also had been director of sales and marketing, which gave opportunities to demonstrate her abilities. "My father made it easy for me," Ms. Smolyansky says.

Often there is no family member ready or willing to assume the leadership of a business. Family connections, though, are less important than knowing how the company runs. For Ms. Rumley and her home-care company, two staff members -- a coordinator and a nurse -- stepped up to take on the temporary leadership. It helped that the business was straightforward and that all of her employees knew their jobs well, Ms. Rumley says.

In other cases, it can be necessary to hire a turnaround or crisis specialist. Such experts can be consultants, retired or unemployed executives, or someone from a turnaround firm. These firms generally charge hourly rates of $150 and up, says Mr. Cockrell, the small-business adviser. The Association of Certified Turnaround Professionals, a Chicago-based certification organization, has a Web site, http://www.actp.org/5, featuring a database of specialists that is searchable by industry and state.

Retired executives can cost $10,000 to $15,000 a month and more. Some ask for a salary 25% above that of the absent chief.

While a small business may consider these tactics to be expensive, says Mr. Cockrell, they may be cheaper than closing the business outright.

Take Financial Precautions

Whoever takes charge can expect a rocky start, along with a possibly significant drop in revenue. It's a good idea for small businesses to have a portion of capital in an emergency reserve fund, several forms of insurance, and a detailed list of instructions covering key duties in the owner's absence.

Many advisers recommend doing annual contingency planning for a key person's absence. They say owners should consider establishing an advisory board made up of the company's accountant and attorney, family members or friends who would know what to do in case of an emergency.

Alliances can be set up with peers and partners to try to stem losses from disruptions in business. Ms. Martinez, for example, had agreements with other contractors who temporarily took on some of her customers. Mr. Cockrell, too, says that when he had his own accounting firm, he and the heads of a few other firms had a mutual-support agreement that if one of them should be disabled, the others would temporarily help with customer needs and projects in progress.

Philip London, senior tax partner with the accounting firm Freeman & Davis LLC in New York, advises his small-business clients to ensure there is a continuation plan in place. When two partners run a business, it's common to set up a buy-sell agreement insured by a life-insurance or a disability policy, Mr. London says.

For example, each partner holds a life-insurance policy on the other. The surviving partner then uses the insurance payout to buy the stock of the deceased partner from his or her family. That sort of situation is used when the owners don't plan to pass the business to other family members.

Less common is so-called key-man life insurance, in which the business is the beneficiary of the policy. Only about 17% of businesses with fewer than 500 employees have key-man life insurance on their chief executives, a 2003 study by Hay Group found.

Other types of insurance, however, are essential -- especially good medical and disability insurance. Disability insurance can cover a business's overhead expenses or some lost income, says Paul Stawinski, managing director at the New York financial advisory firm Price Raffel & Browne Inc.

It's important to note that disability policies will cover only about 60% of income, says Mr. Stawinksi, who also recommends making sure that the policy covers partial disability. Insurance policies should be re-evaluated and revised as the business grows, he adds.

Stay Engaged in the Business

Some owners trying to cope with tragic circumstances find that staying involved with the business can help.

When Troy Dunn discovered that his 9-year-old daughter had cancer, he handed the day-to-day operation of his marketing agency, DunnDeal Consultancy LLC, in Fort Myers, Fla., to his mother; she had already been working at the company. But Mr. Dunn told his staff that while his schedule would be inconsistent, he wouldn't be invisible and shouldn't be treated like he was. Although he had to skip conference calls, for example, he made sure to quickly and effectively make his opinions known after seeing minutes from company meetings.

Mr. Dunn spent many days incommunicado at his daughter's bedside while she was undergoing chemotherapy. He would turn his BlackBerry off during those times. Afterward, he would see messages about matters he once would have considered crises. But scrolling down, he would often discover that those crises had been resolved by his staff or had disappeared on their own.

The year that his daughter was ill, Mr. Dunn says, was actually the most productive so far in his career, a time in which he wrote a book and secured a television deal. If he hadn't made some commitments, like signing the book contract, before his daughter's diagnosis, he says he probably would have put them off. But having to focus on them helped during the most difficult times.

His daughter's cancer is in remission now, and she has returned to school and playing sports.

Ms. Rumley, for her part, says that despite the difficulties it caused her at the time, having the business was her saving grace. At a particular low point during her chemotherapy, she says, she sat on the couch in her house and cried to her father that she couldn't manage everything that was going on in her life.

But the next day, she decided she couldn't sit on the couch and cry anymore, and would start going back to the office, working only half-days at first. She also hired a woman from her own agency to help her with housework as she was recovering.

Share...but Not Everything

One of the most difficult of the many balancing acts required is deciding where to draw one's line of privacy, and what to share with employees and clients.

Mr. Dunn asked his mother to be the spokesperson for the family and to keep everyone updated. He didn't want every phone conversation with employees or clients to start with questions about his daughter, he says.

"We had to keep the sad people at arm's length," since soon the crisis wasn't new to him but was new to someone in his extended network every day for months. He felt drained talking to people about it every day, he says.

Ms. Rumley called each of her staff individually to break the news of her diagnosis and to assure them that the business would go on.

Telling clients is another matter. Mr. Cockrell says the amount of information to be shared should depend on how much clients are affected by an owner's absence. If a partner at an accounting firm is ill and his colleagues take on the burden and spread the work, managing to deliver projects on time, then the client doesn't necessarily have to know, he says. But in many other cases an owner's absence may delay deadlines and reduce oversight, Mr. Cockrell says, in which case it's only fair to tell the client.

Don't Make Rash Decisions

At one point Ms. Rumley's father was so concerned for her health and energy that he called the coordinator who was in charge of her business and told her to begin shutting the company down. Ms. Rumley reversed her father's decision after she learned about it, and had to talk to her coordinator, through tears, to assure her that indeed the business would keep running.

Things were bad, she says, and everyone thought it was all over. "But I didn't think so."

In the years that followed, Ms. Rumley says her father, who has since passed away, was proud of her keeping the company going and enjoyed hearing stories about her business.

"He was thrilled," she says. "He knew it was a good decision."

--Ms. Chernova is a reporter for Dow Jones Newsletters in Jersey City, N.J.